We often encounter customers who are running old versions of Microsoft on their shop floors. We strongly advise that customers read this quick blog on Windows 10 migration for your manufacturing operation.

We often encounter customers who are running old versions of Microsoft on their shop floors. We strongly advise that customers read this quick blog on Windows 10 migration for your manufacturing operation.

Countdown to January 2020

Microsoft is ending support for Windows 7 on January 14, 2020. This means people will be upgrading their PCs to Windows 10 in the next 18 months. While this sounds like a long window of time, it’s best to take care of it sooner rather than later.

Virtualizing

Customers are virtualizing their servers. This means they take a physical PC/computer and move it to a much larger server that can host many computers virtually. This eliminates the hardware for that PC but generally requires a migration.

Now > Later

We strongly suggest customers take care of this Windows 10 migration now, as a lot can go wrong with a migration. Some issues can be improperly entered codes, incorrect driver configuration, or forgetting to backup critical files. There will also be customers who will be waiting to upgrade at the last moment due to multiple factors, which can be a frustrating feeling.

Need Help?

SFA has a procedure that our technicians follow when doing a migration. Testing and tweaks are typical after a migration due to changes in the operating system. SFA knows what these changes are based on experience.

Call (877) 611-5825 so we can help with your Windows 10 migration process. We also recommend you fill out our contact form if you’re reaching out for the first time. If you are on a current Support contract, fill out a form today.

We often encounter customers who are running old versions of Microsoft on their shop floors. We strongly advise that customers read this quick blog on Windows 10 migration for your manufacturing operation.

We often encounter customers who are running old versions of Microsoft on their shop floors. We strongly advise that customers read this quick blog on Windows 10 migration for your manufacturing operation. As American manufacturing grows, efficient machining is key. SFA is often asked about secure and quick CNC to PC communication. Here, we take a look at CNC remote request procedures.

As American manufacturing grows, efficient machining is key. SFA is often asked about secure and quick CNC to PC communication. Here, we take a look at CNC remote request procedures. “Revision control is the management of modifications done to software applications, sites, documents or any set of information,”

“Revision control is the management of modifications done to software applications, sites, documents or any set of information,” Before retiring from

Before retiring from  Here are some SFA pieces of product news and MFG Day coverage. Manufacturing Tomorrow especially shared a few of our pieces.

Here are some SFA pieces of product news and MFG Day coverage. Manufacturing Tomorrow especially shared a few of our pieces. Does getting your shop floor paperless, organized, ready for an audit, and functioning sound impossible? Trust us. It’s not.

Does getting your shop floor paperless, organized, ready for an audit, and functioning sound impossible? Trust us. It’s not. Haas Automation is celebrating the 30th anniversary of their Haas VF-1 vertical machining center with Haas Demo Day 2018!

Haas Automation is celebrating the 30th anniversary of their Haas VF-1 vertical machining center with Haas Demo Day 2018! When working production on a manufacturing shop floor, productivity issues happen. Nothing is perfect – this includes your employees and equipment.

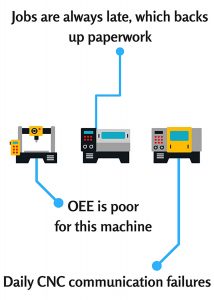

When working production on a manufacturing shop floor, productivity issues happen. Nothing is perfect – this includes your employees and equipment. Unplanned downtime and the impact on production are common aggravation factors in manufacturing jobs. New manufacturing software on your shop floor in 2018 could help with this stress.

Unplanned downtime and the impact on production are common aggravation factors in manufacturing jobs. New manufacturing software on your shop floor in 2018 could help with this stress.